Epigraphs are showing up more often — in fiction, nonfiction, and even before chapters.

They lend your book a sense of weight, signaling a deeper connection or influence.

In nonfiction, they can even boost your credibility.

And yet, if your epigraph is poorly chosen or the formatting is unprofessional, it will throw readers off.

Furthermore, an epigraph is one of the first things that readers see. If it does not look right, or doesn't have relevance to the subject matter, it will likely lead to some negative reviews of your entire book, regardless of the content's quality. And all of that could be avoided.

Thankfully, the rules for good formatting and proper use of epigraph are relatively simple. If you follow the advice in this article, you shouldn't have any problems.

But, what exactly is an epigraph and how do you write one? Though often confused with an epitaph (an inscription on a tombstone), an epithet (a descriptive phrase or adjective), or an epilogue (the final piece of a novel), an epigraph is something unique to all of that.

Want to know more? This post is part of a series of posts all about the different parts of a book. I highly recommend you check them out.

- What an epigraph is

- Some examples of an epigraph

- How you can create epigraphs for your own books

Table of contents

Why Should You Trust Me?

I've actually been writing and formatting books for a long time. Over 10 years so far, and counting.

But that's not the real reason, because there are plenty of authors who have lots of experience, but know next to nothing about the different parts of a book, or book formatting in general.

The real reason you should trust me is because I actually created my own formatting software that solved all my problems. I called it Atticus.

But this isn't meant to be a sales pitch. I just want to make sure it's clear that I know what I'm talking about. The amount of research that went into not only formatting my own books, but also creating a formatting software is huge.

I researched everything, which led me to learn all about every. single. part. of. a. book. And there were a lot more than I realized.

And of course, that includes epigraphs.

So if all that makes sense, hopefully you'll come along with me as show you everything I've learned.

What Is an Epigraph?

An epigraph is a quote, phrase, or poem that appears at the beginning of a text. Some authors also use epigraphs before sections or even chapters. A good epigraph offers a glimpse into your book’s tone, theme, or inspiration.

This literary device can be used in literature, academic writing, or even to open a short story or an essay.

Epigraph vs Epigram

These two literary terms are often confused — and with good reason. But, they are different, as you'll see below.

An epigram is a short, witty statement — often poetic, usually satirical.

An epigram can be used as an epigraph when placed in quotation marks after the title page of a book or at the beginning of a text.

What are Some Epigraph Examples?

The following examples glimpse the wide range of unique epigraphs various authors use for their books.

The Stand by Stephen King

Stephen King uses epigraphs in many of his books, usually before each new section. However, in The Stand, King doesn’t just quote existing books, he quotes song lyrics.

The book begins with quotes from songs by Bruce Springsteen, Blue Oyster Cult, and Country Joe and the Fish. But he doesn’t end there; he also quotes the poet Edward Dorn.

All four quotes add their own flair to the novel and provide the reader a glimpse into the theme of the book. Another epigraph later in the novel quotes a Larry Underwood song. If you’ve read the book, you know that Larry Underwood is a major character in the novel, a musician in the fictional world King has created.

So, your epigraph doesn’t have to be from a real person; it can be fictional. And this brings me to my next example.

The Malazan Book of the Fallen by Steven Erikson

Steven Erikson’s fantasy series The Malazan Book of the Fallen features fictional quotations in the form of poems written by fictional characters in his expansive universe. Erikson’s fictional epigraphs use poetry to set the mood and give the reader a more textured vision of the world he has created.

Long before Erikson wrote The Malazan Book of the Fallen series, J.R.R. Tolkien did something similar in the Lord of the Rings books, starting each book with the same poem, featuring the famous lines:

“…One ring to rule them all, One ring to find them,

One ring to bring them all and in the darkness bind them…”

The Sympathizer by Viet Thanh Nguyen

The Pulitzer Prize-winning novel by the Vietnam-born author and professor is a great traditional epigraph example. This powerful and gripping novel begins with a brief quotation from Friedrich Nietzsche:

“Let us not become gloomy as soon as we hear the word ‘torture’: In this particular case there is plenty to offset and mitigate that word – even something to laugh at.”

-Friedrich Nietzsche, On the Genealogy of Morals

Even if you aren’t sure what The Sympathizer is about, the short quotation gives you a glimpse at the tone of the story to follow. It helps to prepare the reader for what is to come and even piques a little curiosity by referencing this well-known literary work.

How to Write an Epigraph

As you know by now, utilizing an epigraph is usually a matter of choosing the right one, not so much writing one. If you’re writing fantasy novels, you could write your own epigraph, but it’s by no means required.

If you do decide to use (or write) one, allow the tips below to help you.

- Consider quoting any works that have influenced you as a writer and whose theme matches that of your book.

- In nonfiction, epigraphs often come from sources you’ll quote later in the book — giving early weight to your argument.

- Decide if you want a single epigraph or multiple. If your work is split into parts, you may want to use an epigraph before each one, or you could even use one before each chapter.

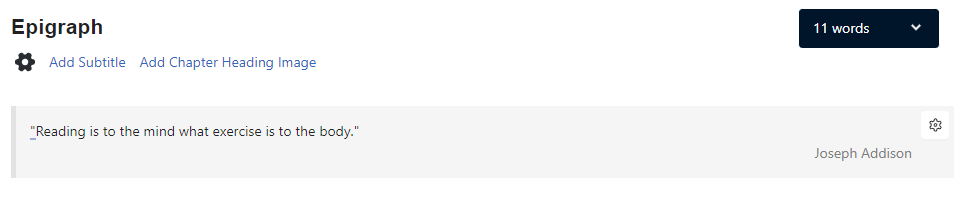

How to Format an Epigraph

Made in Atticus.io

There aren’t really any concrete rules when it comes to the use of epigraphs in literature. It’s ultimately up to you whether you use one or not. As King, Erikson, and Tolkien have shown us in their books, you can write your own poetry, quote a song, or make up an epigraph.

You can quote a speech, an ancient text, a play, or just about anything you want. But it’s a good idea to get permission to use the quotation and to format the epigraph properly. Here are some tips to do so:

- Indent it from the left just like you would a block quotation.

- Make sure to use quotation marks around the phrase.

- Under the block quote, flush right and with an em dash, should be the author's name.

- Literary epigraphs mostly follow this formatting, but there are always exceptions.

- Get permission to use the quote if necessary.

- If you are placing an epigraph at the front of your work, make sure it is ordered correctly (see below)

If you are formatting in a program like Microsoft Word, and already have your trim size, margins, gutter margins, font licenses (be sure you have the commercial license for all fonts, most people don't), then formatting the epigraph should be relatively simple.

Thankfully, a program like Atticus will help to do this for you.

Not only will it take care of the trim sizes, gutter margins, and page numbers all automatically, but it will also create beautifully formatted books with a consistent design. And you won't have to worry about any lawsuits from the fonts you use, which might get you into trouble if you're using your own fonts with MS Word.

Getting Permission to Use a Quote

While most people probably won’t mind (and may even be flattered) that you chose a quote from their work, it’s always best to get permission. You’ll need to seek out the holder of the copyright to ask for permission.

However, if the work you wish to quote is in the public domain, you should be in the clear to use it in your book. Laws vary from country to country, so it’s a good idea to do a bit of research before putting the quote in your book.

What Comes After the Epigraph?

An epigraph can exist in multiple places in your book, but if you are using an epigraph in the front matter, it should be the last thing you have before you start the main chapters.

Here's the most common formatting order for the front matter of a book.

- Title Page

- Copyright Page

- Table of Contents (i.e. chapter headings)

- Dedication Page

- Acknowledgments

- Foreword

- Preface

- Epigraph <<<

Not every book has each of these elements. Again, it’s up to you as the author to decide which ones you want to include.

Pro Tip: If you're unsure what order to put your front matter in, Atticus has you covered. By default, the program automatically puts each part of a book in the correct order, so you don't have to worry about getting your epigraph where your foreword should be.

Video: What is an Epigraph and How to Write One

For a nice summary of this article, along with a few of my own personal thoughts on the subject, be sure to check out this video. In it, I define what an epigraph is, the role it plays in your book, and how to write/collect your own.

Want more videos like this? Be sure to subscribe to my YouTube channel for weekly videos!

How to Ensure an eReader Doesn't Skip Your Epigraph

You may have noticed that when you open an eBook on a Kindle or other device, that it usually doesn't start at the very beginning (i.e. the cover of your book).

Instead, Amazon and other retailers estimate where the book starts, and in some cases this can lead to a reader starting with chapter 1 and completely missing your epigraph!

If your epigraph matters, you don’t want readers skipping it. That’s why setting the correct Start Page in your eBook file is crucial.

Thankfully, Atticus is the only formatting program that lets you do this.

All you have to do is go to the Book Details and scroll down until you find the section labelled Start Page.

From there, you simply select where you would like readers to start when they open your book for the first time.

This inserts a special code into the eBook file that lets Amazon know exactly where to open the book for new readers. Simple as that!

Atticus is the currently the only formatting software that lets you customize the Start Page of your book, and not only that, but it also works on virtually every platform, and it's over $100 cheaper than the competition (which does not have this Start Page feature).

Final Thoughts

Many books do fine without the use of epigraphs. Most authors use them as a way to provide texture to the story while also giving homage to their influences. The right epigraph can pull the reader in and prepare them for what they’re about to read.

Using an epigraph is totally up to you as a writer. But if you do decide to use one, make sure to get permission first so you don’t run into any legal issues. Of course, you can always make one up if it works for your particular book.